First Department: Parties’ agreement to settle their dispute “subject to” execution of a formal contract was enforceable.

Go New York Tours, Inc. v. Tour Central Park Inc., 216 A.D.3d 455 (N.Y. App. Div. May 9, 2023).

Agreements to agree are unenforceable. But it is not always clear whether an agreement is an agreement to agree or a binding final agreement. This is particularly true when an agreement states that it is “subject to” a definitive final contract.

“Go New York Tours” and “Tour Central Park,” two competing businesses offering bicycle rentals near Central Park in New York City, were able to resolve their trademark dispute in mediation. At the conclusion of the mediation, the parties agreed on settlement terms, memorialized in an exchange of emails, which they agreed were “subject to a formalized Settlement Agreement.” When Go New York Tours sued Tour Central Park to enforce the settlement, Tour Central Park argued the parties had never reached agreement.

The Appellate Division, First Department disagreed. The “subject to” language alone did not amount to “an explicit reservation that there would be no contract until the full formal document is completed and executed.” Accordingly, the parties had entered a valid settlement agreement. The court also relied on the parties’ subsequent actions—including their correspondence with each other and the court—as evidencing their shared understanding that a deal had been struck.

Read the court’s full decision here.

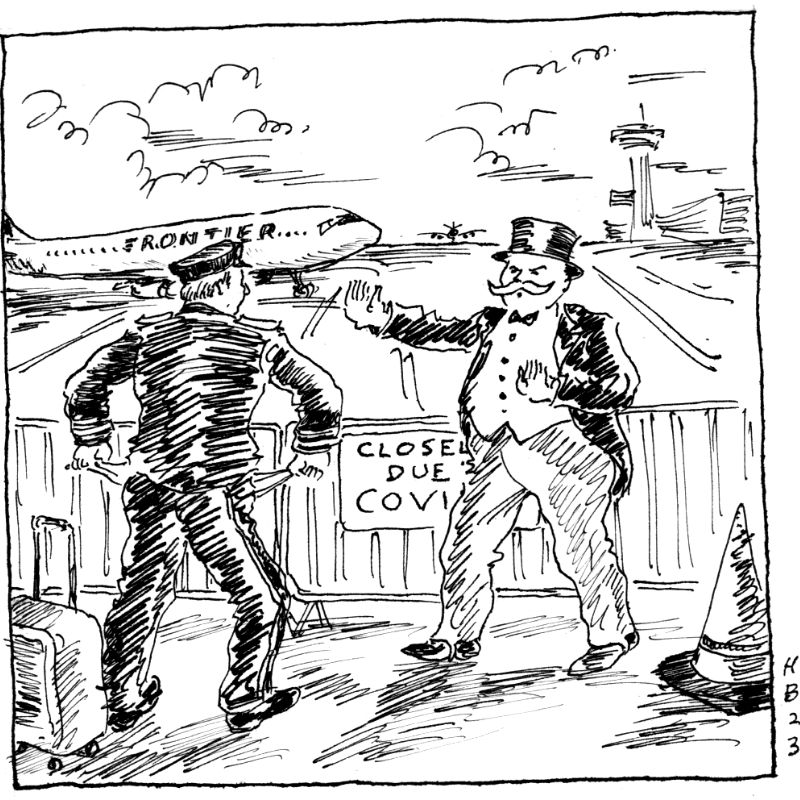

Southern District of New York: Aircraft lessor did not anticipatorily repudiate contract in renegotiating obligations during COVID-19 pandemic.

Frontier Airlines, Inc. v. AMCK Aviation Holdings Ireland Limited, 2023 WL 4364450 (S.D.N.Y. July 6, 2023).

Anticipatory repudiation (also called anticipatory breach) occurs when a party unequivocally states it will not perform its contractual duties. Commonly, anticipatory repudiation involves a party advancing an unwarranted interpretation of the agreement or conditioning performance on extra-contractual demands. Moreover, if a party has “reasonable” grounds to fear its counterparty will breach, the counterparty’s failure to provide requested adequate assurance of its performance may also constitute anticipatory repudiation.

Frontier Airlines sued aircraft leasing company AMCK claiming that AMCK anticipatorily repudiated the parties’ aircraft sale leaseback agreement. The alleged anticipatory repudiation occurred when, during the widespread financial disruption caused by the COVID 19 pandemic, Frontier Airlines sought to negotiate deferrals on required rent payments to AMCK. As part of those negotiations, AMCK sent emails and texts to Frontier proposing amended terms, like requiring Frontier to prepay rent and delaying the delivery of aircraft, in exchange for the rent deferrals. Ultimately, no agreement was reached, and Frontier purported to terminate the parties’ agreement over outstanding rent payments. Suing AMCK for anticipatory repudiation, Frontier argued AMCK’s communications conditioned AMCK’s performance on extracontractual demands and gave Frontier reasonable grounds to believe AMCK would not perform.

The court found no anticipatory breach. Interpreting AMCK’s communications as repudiations “would require the Court to read them in isolation and out of the context of the ongoing negotiation.” Instead, the communications were merely “a quid pro quo that is standard in all negotiations” and “d[id] not approach the level of an unequivocal repudiation.” Similarly, because the parties were negotiating a rent deferral, Frontier never had “reasonable grounds” to believe that AMCK would not perform. Accordingly, the court granted summary judgment in favor of AMCK on the anticipatory repudiation claim.

The court also addressed other claims by Frontier against AMCK and its financing partners.

Read the court’s full decision here.

Second Circuit: Because Citibank’s Argentinian branch was not a legal entity, it lacked standing to enforce arbitration clause and seek injunction against foreign judgment.

Branch of Citibank, N.A. v. De Nevares, 74 F.4th 8 (2d Cir. 2023).

Under Article III of the United States Constitution, federal courts lack jurisdiction over disputes that do not involve a “case or controversy,” and there is no case or controversy where a plaintiff is not a distinct legal entity that has suffered cognizable injury in its own right. This core constitutional principle of standing defeated an attempt by the Argentinian branch of Citibank to block enforcement against it of an Argentinian judgment against Citibank.

Alejandro De Nevares, an Argentinian citizen and former employee of Citibank in New York, obtained a judgment against the bank in Argentina. Seeking to prevent De Nevares from enforcing his judgment in Argentina, the Argentinian branch successfully obtained an order in the Southern District of New York compelling arbitration under De Nevares’ New York employment agreement and enjoining De Nevares from enforcing his judgment against the branch.

But the Second Circuit reversed. On appeal, De Nevares contested subject matter jurisdiction. He maintained that, under Argentinian law, the Argentina branch was not a legal entity and did not exist separate from Citibank. Hence, because Citibank itself was not a party to the action, there was no adversity (and, therefore, no “case or controversy”). Following a de novo review of Argentina law, the Second Circuit sided with De Nevares. The court allowed that Citibank could have cured the lack of adversity by substituting itself for the branch as plaintiff. But both Citibank and the branch had consistently taken the position that Citibank was distinct from the branch, and that De Nevares’s sole recourse was against Citibank, not the branch. As a result, given Citibank’s unwillingness to take its branch’s place in the proceedings against De Nevares, the Second Circuit dismissed the case for lack of subject matter jurisdiction.

Stay informed of Chaffetz Lindsey’s updates, new articles, and events invitations by subscribing to our mailing list.